This year (2020) I used Finmo to help me file my tax return. And boy… am I so glad I came across it!

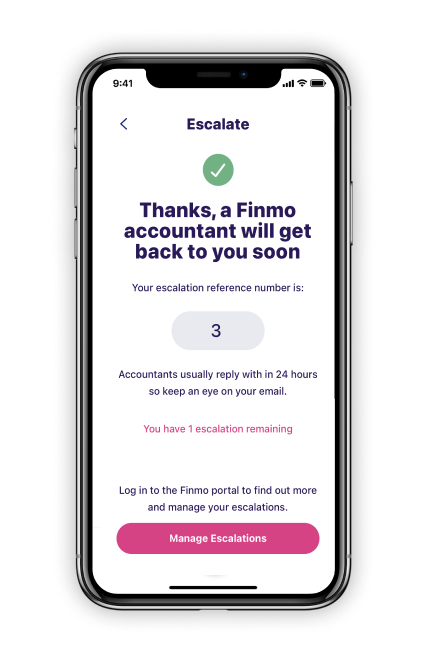

This app helps sole traders save time, money, and stress when tracking their income, and expenses. It helps your confidence when submitting your tax and has useful features like Escalations, giving you personalised advice from an accountant.

As a solopreneur, filing your taxes is completely different from when you are an employee.

You are in charge of ensuring your Self Assessment is submitted correctly.

Otherwise, the fines for not filing your Self Assessment correctly, or not filing at all can come at you hard!

This is something you want to avoid, and Finmo helps with that.

Here are 7 reasons you, as a sole trader freelancer, should be using this tax app!

1. It’s Free To Track Your Expenses

Finmo is free to download and what’s even better is that includes the main features to track and claim your expenses and calculate your taxable income!

This makes downloading and tracking accessible to everyone!

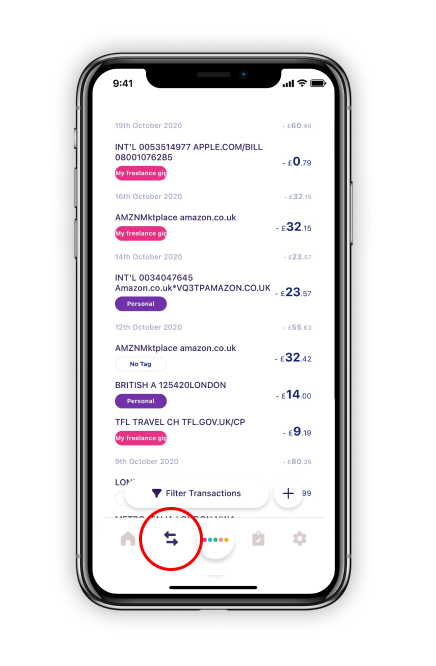

2. It’s Easy To Use Finmo

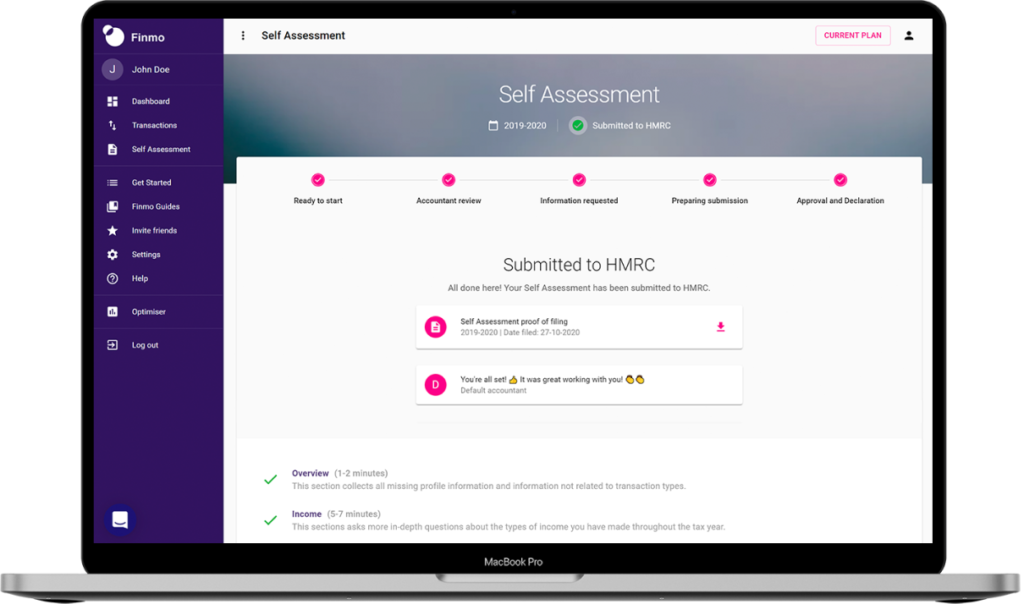

From signing up to connecting your bank account to the app, using Finmo is super smooth.

Taxes can seem complicated, especially for beginners, so having this tool that makes this easier helps immensely.

3. Finmo Have Affordable Services Too

If you’d rather someone else deal with all your taxes, Finmo also offers affordable services where an accountant can file your taxes for you from just £119. You can also export all your data as a backup for just £25!

4. Finmo Is Specifically Designed For Sole Traders

Finmo is especially great for freelancers because they specialise in helping sole traders.

As freelancers, we often do a lot of things ourselves, so having an app that is designed with us in mind to deal with taxes assures you that you’re safe in their hands. They’re experts in their field and they’re always willing to chat and give advice when you need it.

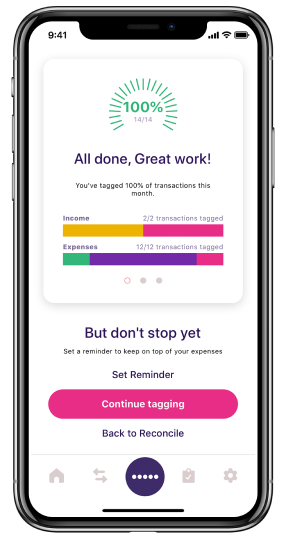

5. Colourful Illustrations

Finmo creates a fun experience when using their app.

The colourful pie charts and visuals tailored to your income, help you clearly see what you have achieved financially throughout the year.

6. Provides You With A Summarised Grossed Income

Finding out your annual gross income can sometimes take a while to calculate by yourself.

But Finmo does the maths for you! Once you’ve tagged your expenses and inputted your income for the year, Finmo tells you your gross income.

7. You Get Discounted Referrals

If you sign up with my link, you’ll get £10 off the cost of any paid plan.

When you sign up, you can invite friends and the person you’ve referred gets £10 off a paid plan. If they purchase a complete plan, you will get a £10 Amazon voucher.

There’s really nothing to lose when signing up to Finmo as a freelancer! So, what are you waiting for? Sign up here!

Please note this post is sponsored by Finmo.

If you’re looking for guidance on starting and landing clients as a freelancer, check out my Beginner Freelancer E-course.